apologize for tempting you to follow me, three issues ago, into the investment world with our

newsletter discussing gold. But my apology is too late, because already some readers have asked us to

explain the stated ‘lousy investment’ associated with house ownership. This, of course, has to lead us to

the subject of maximizing our investments and the dream of many: to make $1 million dollars. Now my

challenge is to not only answer these enquiries but to maintain the true purpose of these CCCC

newsletters, which is to assist you in the development of your enterprise. Well, here goes……..

First, the House

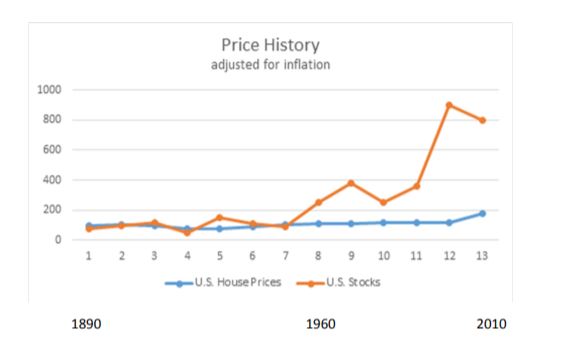

Only last week, I read a financial advisor in the Globe and Mail who talked about the ‘poor’ investment

associated with homeownership. Unfortunately, his focus on changing interest rates and declining house

prices did not capture the full picture. Let us state it graphically with a chart of house prices over the past

120 years, adjusted for inflation according to Bloomberg data.

As you can see, the house price is pretty flat when adjusted for inflation, whereas stock prices move

bravely upwards. You can make a comparison yourself to test the validity for your own home. I will use

one of my own for example, on Fourth Avenue in the Glebe in Ottawa. Purchase price in 1970 was

$29,000. Value in 2016 $700,000. Looks pretty good doesn’t it? Next refer it to the price of gold in 1970

and the house was worth 420 ounces of gold. Today, in 2010, my $700,000 house at a current gold price

of $1653/oz. is worth 423 oz. of gold. Wow, up 3 oz. in 45 years. My, oh my! Now, do it for your own

home. It may be wise to buy a home to satisfy the emotional need for home ownership, or as your way to

keep up with inflation, or to force you into some life-long savings mechanism. The results tell us that

these are not wise investment reasons, but rather seat-of-the-pants justifications for buying a home.

Banks just love home owners with large mortgages. Some people ask, why throw your money away on

rent? You could just as well ask: why throw your money away on mortgage interest?

Second, investing safely

The chart above shows the stock market moving up swiftly compared with house prices, which provides

us with a clue as to where you should invest. It also shows the dangers of that same stock market moving

down just as aggressively, sometimes, as it moves up. What to do? What you know is that (a) over the

long term the stock market moves up; (b) it will rise sharply sometimes; (c) it will decline sharply

sometimes; and (d) you have no idea when that will be. Not knowing the predictability of individual

stocks, the answer is to invest in the entire stock market rather than individual stocks. You can buy

Standard and Poor’s 500 Index Fund, a collection of a huge part of the stock market, and watch it mirror

the orange curve shown above.

How to Make a Million Dollars

We will begin with a few assumptions. (1) You are 40 years old and plan to invest for another 30 years.

(2) You have a professional job with a steady income. (3) You really want to have $1 million when you

reach 70. (4) You will instruct your bank to invest the required amount each and every month from your

account.

Step one is to invest in S&P 500 Index Fund through a fiduciary, not a broker. When the stock market is

examined over 200 years (1802 to 2002), it shows an average annual increase (adjusted for inflation) of

6.6%. That 6.6% is what you will hang your hat on. A table with compounded interest illustrates that an

investment by you of $946/month will result in an accumulation of your million dollars in 30 years

(to be precise, $1,000,769). If you and your wife are partners in this venture, then maybe it would be

$473/month each into the program (probably less than 10% of your incomes). Since that is adjusted for

inflation, your kitty in 30 years will probably be 3 or 4 million, but we are keeping the conversation in

today’s dollars. Now there are all sorts of other steps you can take to enhance or speed up this return

such as diversifying your portfolio, 60% safe and 40% for a bit more risk. Or allocating 50% of any pay

raise to be invested on top of what you are already saving.

OK. You get the picture. The $1 million is achievable, without risk, with a lot of discipline, and no need

for luck or divine intervention.

Meanwhile back at the CCCC Ranch

To return this newsletter to its intent of business advice, I rationalize that we business people are in our

enterprises to make money. Therefore, if I advise you through savings how to make your future secure,

I am giving you business advice. Hopefully your business can make you $1 million in a lot less time than

30 years – but if it doesn’t, you have this fall-back position.

Good luck,

Bill